(Bloomberg) -- The biggest rally in three years for Toyota Motor Corp. shows how a well-timed campaign to promote the carmaker’s EV strategy can pay off, but a dip in support for Chairman Akio Toyoda at a shareholders’ meeting served as a reminder of the perils of drawing investor ire.

A 13% rise in Toyota’s stock added ¥4.4 trillion ($31.4 billion) in market value this week, after the company shared details of how it plans to catch up in the global shift to electric vehicles, buoyed by a global rally in the shares of Tesla Inc. and other EV makers.

The rosy results were undermined, however, by Toyoda’s reappointment to the board with 85% of voted shares — a decline from 96% last year and the lowest on record for him since 2013, according to Toyota. Big US pension funds and European investors had pressed for a vote against Toyoda, arguing that the carmaker had fallen behind rivals because of his approach of offering customers various options by selling gasoline and hybrid cars while investing in EVs, hydrogen and alternative fuels.

Before ceding the chief executive officer title to Koji Sato in April, Toyoda steered the company founded by his grandfather to surpass Volkswagen AG as the world’s largest carmaker. A race-car driver and passionate advocate for Toyota, he has faced criticism for arguing that the transition to EVs will take longer than people expect, and that the industry isn’t ready to make the shift without ample resources and carbon-neutral sources of energy.

“Shareholders are keenly watching how Toyota’s BEV strategy will change under Sato,” said Bloomberg Intelligence analyst Tatsuo Yoshida. “Everything else is minor.”

Even after announcing a ¥4 trillion commitment to accelerate its shift into EVs in late 2021, the company still came under fire, especially in the weeks leading up to this week’s annual meeting.

The pivot in messaging started early in Sato’s tenure, when he began talking about the need to better communicate Toyota’s strategy. That culminated last week in a day of technology briefings at a research center near Mount Fuji, where Toyota gave journalists and analysts a look at the tools and technology it will deploy in coming years to rapidly expand EV production.

“We will continue to pursue sustainable growth as is expected by shareholders, and accept the harsh opinions we received from a number of them,” a Toyota spokesperson said. “We will continue to have an open dialogue with all stakeholders.”

Reports from the workshop ran Tuesday, the day before the shareholder meeting at the company’s headquarters in Aichi Prefecture. Chief Technology Officer Hiroki Nakajima said consumers transitioning from hybrids to EVs have provided a good indication of where demand will be in 2026 and that “development and production will be ready.”

Now that Toyota has effectively launched its comeback, the focus will shift to its ability to execute.

In April, Sato promised that by 2026 Toyota will roll out 10 fully electric models and sell 1.5 million BEVs annually. The company had already committed to selling 3.5 million BEVs by 2030, halving emissions by 2035 and becoming carbon neutral by 2050.

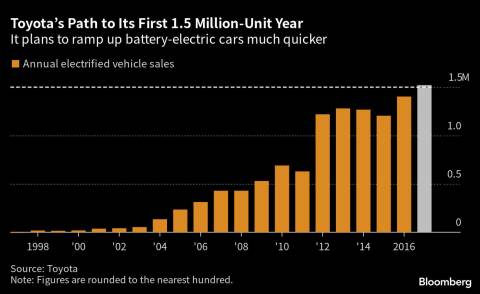

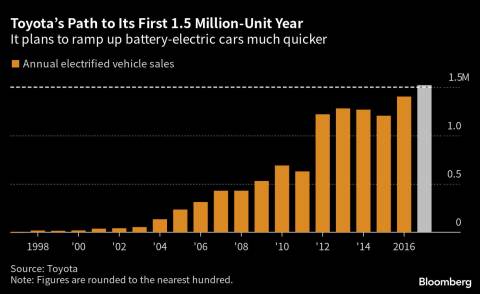

These are lofty goals considering Toyota sold 38,000 BEVs in the fiscal year that ended in March. In comparison, it took two decades for hybrids to reach 1.5 million cumulative sales after the Prius was released in 1997.

“To get those numbers, Toyota will have to outpace Tesla,” said Koji Endo, managing director of SBI Securities Co., who attended last week’s briefing. “Now that they showed they can probably build all those BEVs, the next question is: who will buy them?”

Still, the leadup to Wednesday’s annual meeting was a reminder of the sway that vocal investors can have on a large enterprise such as Toyota, Japan’s largest company by market capitalization. Two of the biggest pension funds in the US — the California Public Employees Retirement System and the New York City Comptroller’s office — voted against Toyoda.

Separately, a shareholder proposal filed by Danish pension fund AkademikerPension, Norwegian financial services company Storebrand Asset Management AS, and Dutch group APG Asset Management NV urged the carmaker to improve disclosure of its lobbying against EV mandates, bans on gasoline cars and other climate policies.

Shinji Kakiuchi, an analyst at Morgan Stanley, called the technology announcement this week the “most aggressive” since Toyoda’s battery EV presentation in December 2021, adding that there’s room for the stock to gain further.

--With assistance from Tsuyoshi Inajima and Supriya Singh.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Author: Nicholas Takahashi