(Bloomberg) -- Japanese life insurers have cut currency hedging by the most in more than a decade, signaling receding concern of a rebound in the yen that would wipe out returns from overseas assets.

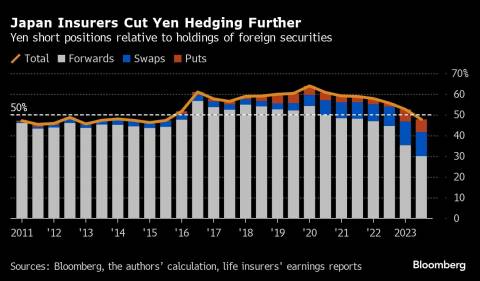

Derivatives including forwards, swaps and put options protected 47.8% of foreign securities held by life insurers at the end of September, down from 52.7% six months ago. The drop of nearly five percentage points in this hedge ratio is the biggest since at least 2011, based on earnings reports from nine of the nation’s largest life insurers compiled by Bloomberg.

The life insurers’ holdings of overseas assets rose by 6.1% over the same period, the first increase since March 2022 and biggest addition in three years. This and the lower hedging suggests that these influential investors see yen weakness becoming more entrenched, in concert with the view that any tightening in monetary policy by the Bank of Japan will be gradual.

A large drop in the use of forwards by insurers — their key tool to protect against appreciation in the yen — more than offset a small uptick in purchases of swaps and options to cope with the increase in hedging costs.

“Life insurers see it very unlikely that the Bank of Japan will tighten policy aggressively,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Ltd. in Tokyo. “They probably see only limited gains in the yen as long as the BOJ keeps policy tightening gradual.”

The Japanese currency has dropped 9% against a basket of its peers so far this year after losing more than 8% in each of 2022 and 2021, according to central bank data on the nominal effective exchange rate. The depreciation has been driven by the divergence of monetary policy between the Asian nation and other major economies, as well as Japan’s weak trade balance.

The BOJ has raised the maximum level that it lets the benchmark 10-year bond yield rise to from 0.25% to about 1% since December 2022. But the move was dwarfed by more aggressive rate hikes by the BOJ’s counterparts in the US and other advanced economies.

Still, prospects for a slowdown in overseas economies increase the likelihood that the Federal Reserve and other central banks are close to or have already reached an end of their policy tightening. They could start to unwind these hikes next year, providing a tailwind for the yen.

While this would rekindle risks for overseas investments by life insurers, it could also lower currency hedging costs from prohibitive levels.

The three-month cost of protecting against the dollar dropping versus the yen is about 5.7%, which makes investing in US Treasuries a loss making proposition for Japanese fund managers if they also use currency hedges.

“It’s possible that the hedge ratios will start to rise early next year,” said Koji Fukaya, a fellow at Market Risk Advisory Co. in Tokyo. “Once the outlook for Fed rate cuts gets clearer or the US economy enters a recession rather than soft landing, the yen will strengthen more.” If the yen rallies beyond 140 to the dollar, more investors may start adopting hedging, he added.

Japan’s currency has strengthened 0.9% this week to trade at around 148 per dollar in Tokyo on Friday.

(Adds yen’s weekly move in last paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Author: Masaki Kondo and Yumi Teso