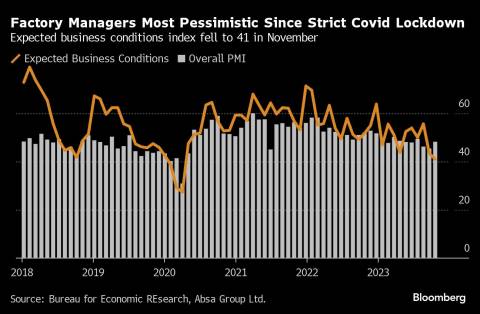

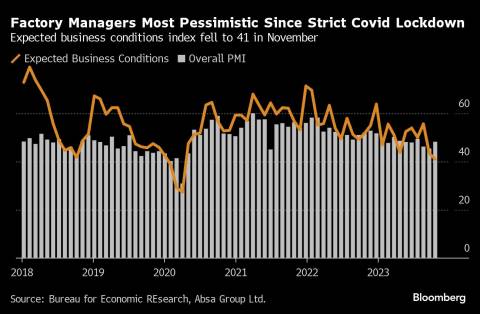

(Bloomberg) -- Factory managers in South Africa are the most pessimistic they’ve been about the outlook for business conditions since the strictest months of a Covid-19 lockdown three years ago, amid continuing power cuts and congestion at the nation’s ports.

An index tracking expected business conditions in six months time fell to 41 in November, signaling that purchasing managers expect business conditions to deteriorate, according to Absa Group Ltd.’s Purchasing Managers’ Index, compiled by the Bureau for Economic Research. The index stood at 43.4 in October.

“Congestion at South Africa’s ports is seemingly resulting in a slower delivery of supplies,” Absa said in a statement. “Beyond issues with logistics, the recent ramp-up in the intensity of loadshedding, following some weeks of respite, may also have depressed forward-looking sentiment,” it said, using the local term for power outages.

The overall Purchasing Managers Index improved to 48.2 in November from 45.4 in October, Absa said. Despite the first increase in two months, the index remains in negative territory.

The supplier deliveries index rose to the highest level since early 2022, driven by the port issues delaying the delivery of supplies. Factory managers are concerned that delays are starting to impact production and could filter through to higher costs, Absa said.

South Africa’s National Treasury on Friday agreed to provide a 47 billion-rand ($2.5 billion) support package to Transnet SOC Ltd., the state-owned port and freight rail operator, to help improve its performance.

Read more: South Africa Agrees $2.5 Billion Support Package for Transnet

The country’s manufacturing sector accounts for about 14% of gross domestic product. Third-quarter GDP data will be published on Dec. 5.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Author: Simbarashe Gumbo