(Bloomberg) -- For carry traders battered by the dollar’s rally and higher US borrowing costs, the euro’s worst plunge since 2005 couldn’t have come one moment sooner.

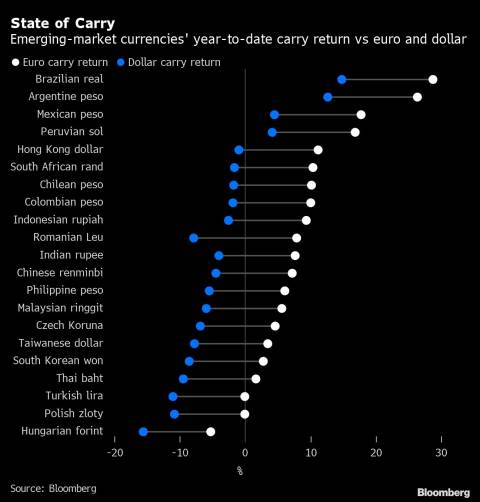

Investing in emerging-market currencies with borrowed euros is raking profits of as much as 29% this year depending on the choice of the higher-yielding currency, according to data compiled by Bloomberg. The gains are being driven by the euro’s 10% drop against the dollar, which took the cross to parity for the first time in two decades.

Those who funded the same carry positions with the greenback had much less lucrative results: not only the overall strategy is failing for a third successive year, but most individual emerging-market currencies are also producing losses. Even in Latin America, profits have stalled after a stellar start. Needless to say, traders are switching.

“Funding carry trades by selling euro is becoming more common,” said Brendan McKenna, a currency strategist at Wells Fargo in New York. “The European Union looks more likely to fall into recession and geopolitical developments should weigh on the currency, making emerging-market carry trades funded by the euro an interesting option.”

Euro-funded carry trades are offering a refuge to emerging-market traders, who are nursing losses across asset classes and strategies amid a surge in the dollar and US yields. A bear market in developing-nation equities is deepening, an index of local-currency bonds is at a two-year low and dollar notes are posting the biggest declines since 1994. If the prospects of a US recession and Federal Reserve tightening continue to fuel a rush into the dollar, the euro carry may well become irresistible to more investors.

There are already signs that the trade will stay profitable for at least the rest of the year. With the euro area staring at a recession, the ability of the European Central Bank to raise interest rates aggressively is limited. That means the yawning gap in interest rates between emerging markets and the continent faces little prospect of shrinking, which dampens the outlook for the common currency.

“It doesn’t look good for the euro in the second half,” said Marek Drimal, the lead strategist for Central and Eastern Europe, Middle East and Africa at Societe Generale SA. “Even if the ECB surprises with another large hike, there are still substantial risks for the euro before we see a turnaround.”

Exceptional Weakness

It’s not always the case that the euro’s weakness offers emerging-market currencies a carry advantage. More often than not, weakness on one side coincides with losses in the other, leaving little scope for arbitrage. But this time round, the dollar’s surge was more harmful for the euro than to developing-nation exchange rates.

The Chinese yuan climbed to the strongest level against the euro since 2015 in July. The Indian rupee and the Mexican peso touched the highest levels since February 2020. In fact, 18 of the 23 currencies tracked by Bloomberg are higher against the euro than at the start of the year.

Further clues on the euro’s outlook may emerge this week as the start of the summer-holiday peak diminishes trading volumes and stokes volatility. The common currency has posted losses in August over 10 of the past 15 years. Investors will also be parsing purchasing managers’ indexes from developing nations including China and India, with those of the euro zone.

“Europe is on the brink of disaster,” Edouard de Langlade, the founder of hedge fund EDL Capital wrote in a letter to clients this month. “We could move to a place where the dollar is not strong against everything but the euro gets weak against everything.”

What to watch this week:

- China’s PMIs will probably show the economy taking a hit as mortgage boycotts heap more pressure on distressed developers and intensify a housing slump

- The Reserve Bank of India is expected to increase its repo rate by 25 basis points at its Aug. 5 review

- Turkey’s consumer price inflation is expected to increase to 80.6% in June, as the central bank’s inaction on the main policy lever has kept prices unchecked

- Colombia will release minutes from its last monetary policy meeting

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Colleen Goko