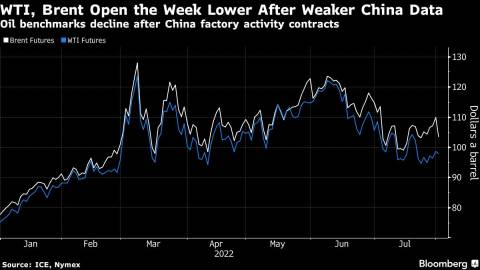

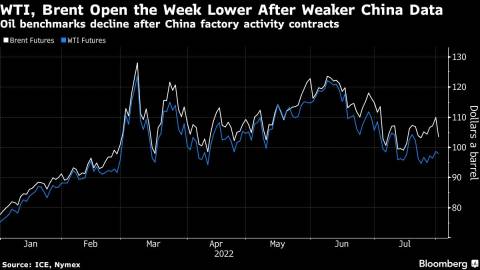

(Bloomberg) -- Oil fell as the week’s trading kicked off, after poor Chinese economic data added to concerns that a global slowdown may sap demand.

West Texas Intermediate dropped toward $98 a barrel after sinking almost 7% in July in the first back-to-back monthly loss since late 2020. Weekend data indicated a surprise contraction in Chinese factory activity, highlighting the cost of Beijing’s preference for mobility curbs to tackle Covid-19.

In Libya, meanwhile, crude output has rebounded after a series of disruptions that more than halved supply, according to the OPEC member’s oil minister. Production has returned to 1.2 million barrels a day, a level last seen in early April, Mohamed Oun said in a telephone interview.

Oil has seen volatile trading in recent months as concerns about a slowdown hurt demand for commodities even as underlying signals pointed to still-tight physical conditions. Data last week showed the US economy shrank for a second quarter, while the Federal Rerserve hiked rates by 75 basis points.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Yongchang Chin