(Bloomberg) -- Stocks in Asia face a mixed start Monday as the economic and regulatory challenges swirling around China temper some of the optimism sparked by a recent rebound in risk appetite.

Futures rose for Japan and Australia but fell for Hong Kong following the best month for global shares since 2020, which pared their slump this year to 16%. Contracts on the S&P 500 and Nasdaq 100 dipped.

Weekend data indicated a surprise contraction in Chinese factory activity, illustrating the cost of Beijing’s preference for mobility curbs to tackle Covid.

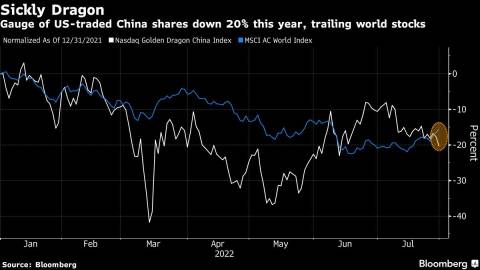

Alibaba Group Holding Ltd. sank in Wall Street trading Friday after being added to a list of firms facing US delisting for failing to provide access to audits. That pushed down the Nasdaq Golden Dragon China Index.

Treasuries begin August with the 10-year yield at 2.65%, down from June’s peak near 3.50%. A slowing economy has cooled expectations for the scale of the Federal Reserve interest-rate hikes needed to tame high inflation, encouraging July’s rally in both stocks and bonds. Equities also got a fillip from resilient US earnings -- over 70% of firms have so far beaten expectations.

“Markets want to trade the ‘peak rates’ narrative which has given risky assets some breathing room,” Eric Robertsen, chief strategist at Standard Chartered Bank Plc, wrote in a note. “We shift our bias from bearish to neutral.”

But Fed officials may be wary of market rallies that ease financial conditions and thus imperil the goal of curbing demand to help control price pressures.

Fed Bank of Minneapolis President Neel Kashkari said Sunday the central bank is committed to doing what’s needed to reach the 2% long-term inflation goal, a target that remains far off. He doesn’t vote on monetary policy this year.

The dollar was steady against major peers in early Asian trading.

Data Friday showed the personal consumption expenditures index -- the basis for the Fed’s inflation target -- rose 6.8% in June from a year earlier.

Elsewhere, investors are monitoring US House Speaker Nancy Pelosi’s trip to Asia. A statement from her office skipped any mention of a possible stopover in Taiwan. A visit may stoke US-China tension over the island.

What to watch this week:

- Airbnb, Alibaba, BP and HSBC are among earnings reports

- PMIs from US, China and euro area, among others, Monday.

- US construction spending, ISM manufacturing, Monday.

- Reserve Bank of Australia rate decision, Tuesday.

- US JOLTS job openings, Tuesday.

- Chicago Fed President Charles Evans, St. Louis Fed President James Bullard due to speak at separate events, Tuesday.

- OPEC+ meeting on output, Wednesday.

- US factory orders, durable goods, ISM services, Wednesday.

- BOE rate decision, Thursday.

- US initial jobless claims, trade, Thursday.

- Cleveland Fed President Loretta Mester due to speak, Thursday.

- US employment report for July, Friday.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1.4% on Friday

- The Nasdaq 100 rose 1.8% on Friday

- Nikkei 225 futures climbed 0.8%

- S&P/ASX 200 futures increased 0.7%

- Hang Seng futures fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2% on Friday

- The euro was at $1.0221

- The Japanese yen was at 133.22 per dollar

- The offshore yuan was at 6.7461 per dollar

Bonds

- The yield on 10-year Treasuries declined three basis points to 2.65% on Friday

Commodities

- West Texas Intermediate crude was at $97.952 a barrel

- Gold was at $1,765.94 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Sunil Jagtiani