(Bloomberg) -- Traders are beginning to question whether the European Central Bank will raise interest rates by more than a percentage point as growth concerns weigh on expectations of aggressive policy tightening.

Money markets on Tuesday briefly indicated that the ECB will be forced to stop before it reaches 100 basis points, compared with bets for more than 200 basis points overall as recently as July 21. The ECB raised interest rates by 50 basis points last month, the first increase since 2011.

Traders are paring bets amid fears that excessive tightening could tip the euro area into a recession. Record-breaking inflation and the heightened likelihood of a Russian energy cutoff are threatening to inflict a slump on the 19-member currency bloc.

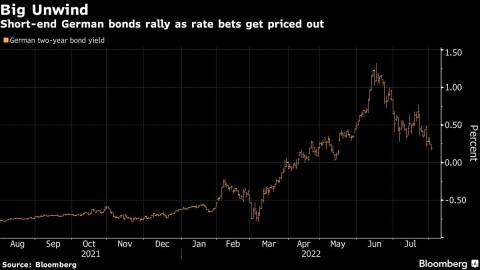

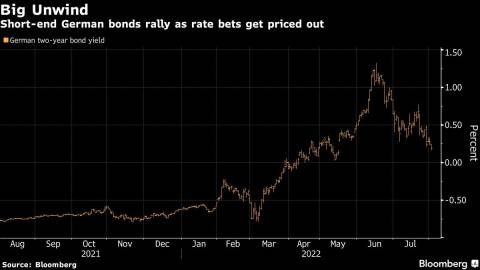

Fading confidence in aggressive hikes is giving a boost to European government bonds. The yield on the two-year German note, among the most sensitive to rate hikes, fell as low as 0.17%, its lowest since May 16. The sector is also benefiting from the bid for haven assets as US-China tension over Taiwan escalates.

(Adds chart.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Alice Gledhill and James Hirai