(Bloomberg) -- Match Group Inc. gave a forecast for revenue in the current quarter that fell far short of analysts’ estimates with growth stymied by continuing fallout from Covid-19 and a strong dollar weighing on overseas sales. The company’s shares fell more than 20% in extending trading.

Sales will be $790 million to $800 million in the quarter ending in September, said the Dallas-based company, which is parent to dating apps including Tinder, OkCupid and Hinge. Analysts, on average, estimated $883.6 million, according to data compiled by Bloomberg. The company said currency fluctuations would have an 8 percentage point effect on revenue.

“Although the overall market opportunity remains substantial, the current environment is presenting some unique trends related to consumer behavior,” Chief Executive Officer Bernard Kim said Tuesday in a letter to shareholders. “While people have generally moved past lockdowns and entered a more normal way of life, their willingness to try online dating products for the first time hasn’t yet returned to pre-pandemic levels.”

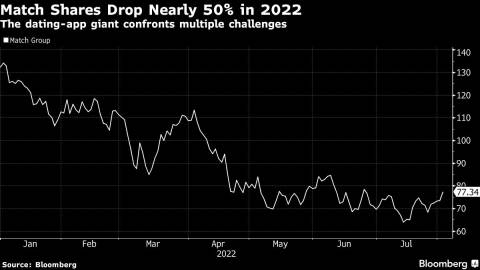

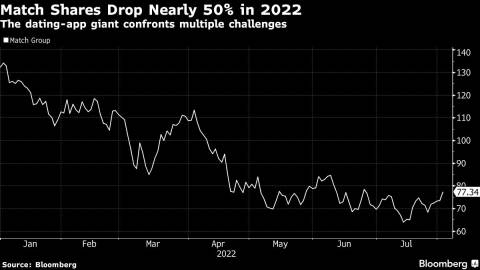

Match has faced multiple challenges this year, including a senior leadership change, a legal battle with Alphabet Inc. over the Google Playstore, lagging growth due to Covid-19 restrictions and a strong dollar weighing on foreign sales. Kim replaced Shar Dubey as CEO after she stepped down at the end of May. Dubey served various roles at the company over 16 years, leaving shortly after the company missed first-quarter revenue estimates and announced a round of share buybacks.

Match also announced Tuesday that Renate Nyborg was leaving as chief executive officer at Tinder, the largest unit. The company is searching for a permanent replacement, Kim said.

“We need some time for the new Tinder team to improve execution and see how they deliver on their product road map,” Kim said in the letter. “We’re optimistic that the changes we’ve made at Tinder will lead to improved product execution and velocity, monetization wins and enhanced user growth.”

Match has been expanding its presence abroad too, with Hinge’s launch in Germany and the acquisition of South Korean video conferencing company, Hyperconnect. This has helped Match grow, but currency fluctuations have hurt the bottom line.

The company said it is seeing “weakness” in its live streaming business and a rise in Covid cases has blunted momentum particularly in Japan.

The shares fell to a low of $58.03 in extended trading after closing at $76.71 in New York. The stock has plunged 42% this year, compared with a 6.3% gain for rival Bumble Inc.

Companies including Microsoft Corp. and Netflix Inc. have cited currency fluctuations for reduced revenue. Match said that it has seen a $74 million revenue headwind to date.

In the second quarter, Match reported revenue increased 12% to $795 million, compared with the average analyst estimate of $804.1 million. Paying users grew 10% to 16.4 million, falling short of the 16.5 million average estimate.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Prarthana Prakash