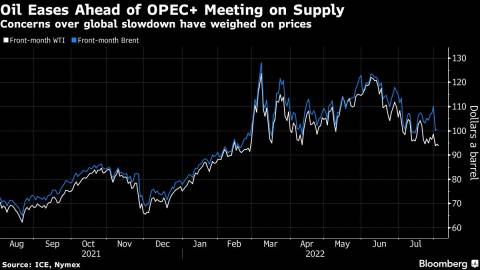

(Bloomberg) -- Oil slipped before an OPEC+ meeting as traders wait to see whether the group will heed a US call to boost supply.

West Texas Intermediate fell below $94 a barrel in early Asian trading after ending marginally higher on Tuesday. The Organization of Petroleum Exporting Countries and its allies convene virtually later Wednesday, and a Bloomberg survey of traders and analysts suggested the alliance led by Saudi Arabia was more likely to keep output steady in September than agree on an increase.

Investors were also tracking the fallout from a visit by House Speaker Nancy Pelosi to Taiwan that’s inflamed US-China tensions and reduced appetite for risk assets. Pelosi, the highest-ranking American politician to visit the island in 25 years, plans to hold a press briefing with President Tsai Ing-wen.

Oil sank to the lowest close in more than five months earlier this week, giving up the bulk of the gains seen since Russia’s invasion of Ukraine. That drop has been driven by signs tight physical markets are easing and as investors fret about an economic slowdown. On Tuesday, speakers from the Federal Reserve signaled the bank would go on tightening monetary policy to quell inflation.

US President Joe Biden visited Saudi Arabia last month in an effort to convince OPEC+ to produce more crude after gasoline prices spiked to a record. Ahead of this week’s meeting, an administration official talked up the prospect for a positive announcement from the group even though some members have been unable to meet current output quotas in full.

Goldman Sachs Group Inc. said it expected OPEC+ to agree to a “modest” increase in output, according to a note from analysts including Damien Courvalin. At present, the global crude market faces a deficit of 2 million barrels a day and stockpiles are near record low levels, the bank said.

Ahead of the OPEC+ session, the American Petroleum Institute reported that US crude stockpiles expanded by more than 2 million barrels, according to people familiar with the data. Government figures will follow later on Wednesday.

Brent crude’s prompt spread -- the difference between its two nearest contracts -- has narrowed to the lowest since May, suggesting the physical tightness is easing. The differential was at $1.88 a barrel on Wednesday, down from above $4 about a month ago.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Yongchang Chin