(Bloomberg) -- The pound snapped a two-day gain after the Bank of England’s bond-buying program failed to quell jitters over the UK’s tax-cut plan.

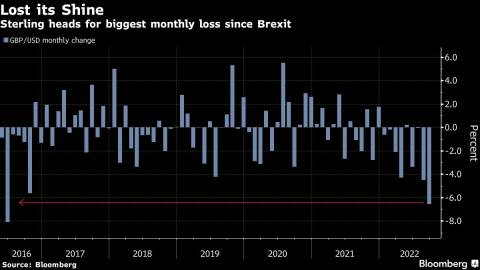

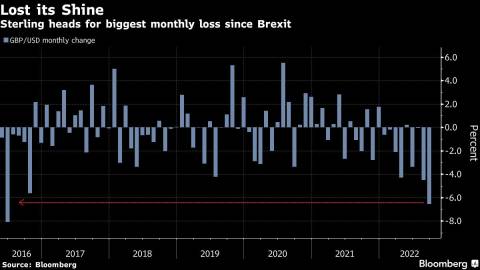

The currency fell 1.1% to $1.0767, paring Wednesday’s surge after the BOE said it would buy an unlimited amount of long-dated bonds until Oct. 14 to stave off a crash in the UK’s bond market. Thursday’s slide puts the currency on track for its worst month since the UK voted to leave the European Union in June 2016.

Everyone from investors to the International Monetary Fund are concerned that the UK’s fiscal stimulus measures could fuel inflation and stoke the nation’s ballooning debt. The currency notched a record low against the greenback earlier this week, triggering talk it may hit parity with the dollar.

Read More: Britain’s Crisis of Confidence Was Years in the Making

(Updates currency move in second paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Matthew Burgess