(Bloomberg) -- The global debt rally extended to Asia after the Bank of England’s surprise bond market intervention sparked a rush of short covering and some of the most extreme volatility in months.

Yield premiums on Asia investment-grade dollar bonds tightened three to five basis points, according to credit traders. They widened 10 basis points Wednesday, the biggest blowout since March 2020, according to a Bloomberg index. That makes for the most volatile two sessions since late June.

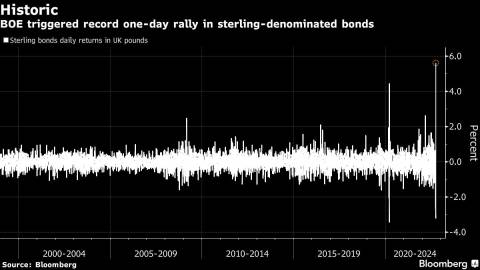

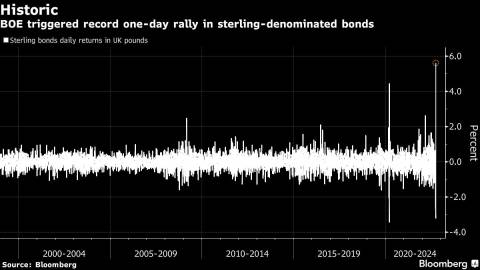

The UK bond market clawed back some of this year’s losses Wednesday, rallying by a record 5.6%, according to a Bloomberg index with data stretching back to 1998. That helped government and corporate notes globally eke out gains of 0.8%, the most in seven weeks.

While the BOE’s dramatic intervention to buy an unlimited amount of long-dated bonds triggered record gains for gilts, concerns about historically high inflation and further monetary tightening by central banks including the Federal Reserve will likely temper any prolonged rally.

“The BOE’s emergency bond buying plan is certainly helping markets calm down,” said Pauline Chrystal, a portfolio manager at Kapstream Capital in Sydney. “But the same issues that lead us to be really cautious haven’t been resolved yet, including inflation in the US.”

Sterling-denominated debt has still lost 26% year-to-date, despite the rally on Wednesday.

The announcement by UK Chancellor of the Exchequer Kwasi Kwarteng last Friday of dramatic tax cuts triggered a run on British assets on concerns about the ability of government to fund the move and its potential to further accelerate inflation.

“The direction of the pound and BOE is a short-term side-show,” said Todd Schubert, head of fixed-income research at Bank of Singapore. “Volatility will likely continue until there is more certainty that inflation has peaked.”

Elsewhere in credit markets:

Asia

The drop in dollar borrowing costs spurred at least three issuers from the region including a unit of Japan’s Komatsu Ltd. to market debt in the US currency on Thursday.

- The impact of the BOE’s intervention on global markets showed signs of waning in Asia as the trading day progressed, with gains on Chinese high-yield dollar bonds easing.

- The BOE’s move may reduce pressure on the Bank of Japan to tweak its monetary policy stance and help bring down Japanese corporate bond spreads, according to Kazuma Ogino, a senior credit analyst at Nomura Securities.

- India’s corporate yield curve is set to invert for the first time in 16 months as cash from the banking system gets drained, amid slower government spending, pushing up money-market rates.

EMEA

The UK tapped its July 2053 green gilt amid chaotic market scenes on Wednesday, with investors piling in amid market turbulence.

- The cost of insuring against European corporate debt defaults on Wednesday surpassed peaks hit during the pandemic, and touched levels last seen during the 2012 euro debt crisis, as investors weighed up risks including energy supply disruptions over the crucial winter period.

- Investors wishing to insure exposure to UK sovereign debt must now pay close to double the cost for Ireland, a country with a lower credit rating which just a decade ago was forced into a multi-billion euro aid bailout.

- Some investors are playing the long game as a fresh wave of misery engulfs European stocks and bonds, betting that gas shortages will speed up a transition to renewable energy.

Americas

Collateralized loan obligation prices are dropping as Wall Street banks retreat, pressured by regulators and buyout debt losses.

- Bonds sold to help US utilities recoup losses from natural disasters are seeing an unprecedented boom, with the latest burst of issuance generated by the deadly February 2021 storm that paralyzed Texas as it struck a large swath of the country

- The two potential issuers that were considering selling bonds in the US investment-grade primary market on Wednesday decided to stand down

- The New York Federal Reserve’s Corporate Bond Market Distress Index showed increased stress in September. The index rose to the highest since Nov. 20, 2020 on a weekly basis

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Finbarr Flynn and Harry Suhartono