(Bloomberg Markets) -- Fashion giant Chanel, known for its iconic perfume and tweed suits, keeps up to date with changing tastes. These days that means showing consumers—and investors—that it’s doing its part to combat climate change.

So when the company needed to borrow money two years ago, it turned to a hot new financial product: sustainability-linked bonds, or SLBs. The investors who purchased Chanel’s €600 million ($589 million) of bonds also got a promise: If the company didn’t meet certain climate goals, it would pay them millions of euros more. In other words, they’d pay a penalty for not being green. Philippe Blondiaux, Chanel’s chief financial officer, said at the time that the deal “was a great way to align our financing strategy with our company strategy centered around our sustainability targets.”

But Chanel and other companies that sell such bonds aren’t risking much. They get to set their own objectives, creating an obvious incentive to make them easy to meet. Most investors, instead of insisting that companies set more challenging goals, seem to be satisfied as long as what they’re buying is labeled green. Demand for the bonds exceeds the amount on offer by two, three, or even five times.

Bloomberg News analyzed more than 100 SLBs worth almost €70 billion that were sold by global companies to investors in Europe—the most mature market for sustainable finance products—and found that the majority are tied to climate targets that are weak, irrelevant, or even already achieved. The result, researchers say, is that companies are getting something for nothing: Cheaper financing and an enhanced green reputation come without any real effort to deliver on climate goals and no chance of financial penalty.

A closer look at the Chanel deal showed that, in fact, the company had fulfilled a key objective before it even sold the bond to investors. The bond required Chanel to reduce its so-called indirect or Scope 3 emissions—basically the emissions produced by its suppliers and customers—10% by 2030. But the company’s own disclosures show that, by the time the bond was issued, those emissions had already fallen 21% below the baseline set in the bond contract. So Chanel was getting to pay its lenders a lower rate for meeting a goal that it had already succeeded in achieving.

So why did investors agree to it? A Chanel spokesperson says the company was still “finalizing 2019 data” when investors bought the bond; in other words, they didn’t know that the target was already achieved. Investors should demand better, says Ulf Erlandsson, a former bond portfolio manager who’s now chief executive officer of the Anthropocene Fixed Income Institute. “I would say, ‘Hey, you guys, you’re taking me for a fool. You’re trying to be a little too cute for your own good,’” he says.

Some investors are beginning to express frustration with SLBs. Stephen Liberatore, head of fixed-income ESG and impact investing strategies at Nuveen LLC, says “targets can be gamed.” Matt Lawton, a portfolio manager at T. Rowe Price Group Inc., slammed them in a mid-September interview for exemplifying some of the most “egregious behavior” by Wall Street and corporate borrowers exploiting demand for green investments.

QuickTake: The Booming ESG Bond That’s Facing Growing Skepticism

Investors are pouring trillions of dollars into financial products that incorporate environmental, social, and governance (ESG) measures alongside hard metrics such as profits, dividends, and share price. Although the goal is to encourage companies to adopt more climate-friendly and socially inclusive policies, the changes are often less than meets the eye.

So far, most ESG investing is in the stock market. But the $22 trillion corporate bond market, where mature global companies such as Chanel go to borrow money from investors, has a particularly powerful role to play. Companies rely on debt much more than they do on stocks.

Bonds are really just fancy loans, another way to borrow money for a limited period in exchange for making interest payments. Except the money for bonds comes from many public investors, instead of from banks or other private lenders. Those investors include people with pensions, who often invest a portion of their money in bonds because they're considered safer investments than stocks.

Bonds help finance everything from day-to-day activities to major acquisitions. If a company with a 15% return on capital can borrow money for 4% a year, that’s a no-brainer. Yet today, about 5% of corporate debt is labeled “sustainable,” or aligned with global climate goals to reach net-zero emissions within decades.

ESG considerations are stopping some investors from lending to carbon-heavy companies. As the pool of investors shrinks and central banks withdraw support to markets, those companies now must offer higher interest rates to attract lenders. Attaching ESG conditions to the debt can persuade investors to rejoin the pool of buyers, helping to lower the interest payments.

The move toward ESG-compliant debt started with something called a green bond, first issued in November 2008. The money raised by this kind of security must be spent on specific activities that help cut emissions, such as building renewable power plants or increasing building efficiency. Even an oil company can attract ESG investors by earmarking green bond money to the right things. That’s one reason the market has grown rapidly; more than $1 trillion worth of green bonds had been sold as of mid-2020.

But companies can’t raise money with green bonds unless they plan to use it for a specific green project. That’s why SLBs were created: Companies can raise money for any purpose. It becomes ESG-worthy by tying the bond’s interest rate (or coupon) to broader sustainability goals. If the company misses the mark, it has to pay a higher interest rate (typically an additional 0.25 percentage point).

The invention of SLBs is shrouded in mystery. One banker claimed she was the first to pitch the idea to a European corporate giant. A finance chief insisted he came up with it on a company ski trip. Others say it was simply a natural evolution of sustainability-linked loans, which in 2021 totaled more than $450 billion. The first of those, made in April 2017, had an interest rate that rose if agreed-upon climate goals weren’t met.

Sustainability-linked loans are almost always private contracts. That lack of transparency could shield plenty of greenwashing (making an activity appear environmentally friendly when it isn’t), says André Abadie, managing director at JPMorgan Chase & Co.’s Center for Carbon Transition. With bonds, by contrast, the sustainability objectives and financial penalties are made public in sale documents, enabling outsiders to see if the contracts are truly achieving their purpose.

Over the past six months, Bloomberg News interviewed more than 30 people involved in the SLB market, representing banks, companies, and financial institutions. Their consensus: The industry needs to evolve before it can live up to its potential.

The SLB market “is broken,” says Krista Tukiainen, head of market intelligence at the Climate Bonds Initiative, a nonprofit that promotes better use of debt for sustainable purposes. “Let’s not kid ourselves that this is moving the needle on climate. It can, but it’s really not right now.”

In January, Julian Kölbel of the University of St. Gallen and Adrien-Paul Lambillon of the University of Zurich compared SLBs with regular corporate bonds issued by the same companies within the past five years. They found that SLBs typically pay about a 0.30 percentage point lower interest rate than a comparable plain bond. The interest rate typically rises only 0.25 percentage point if a borrower misses its sustainability targets, and it triggers much later in the bond’s life, which means the cumulative interest payments are much smaller. That’s why the researchers called SLBs a “free lunch” for the companies that issue them.

For now, there are no penalties that are greater than a 1 percentage-point increase in the bond’s interest rate. Both the carrot (a low interest rate) and the stick (a bigger step-up in interest rate) need to be made bigger, says Anthropocene Fixed Income Institute’s Erlandsson.

Even if the penalties were sizable, Bloomberg News’s analysis of more than 100 SLBs showed that none was at a real risk of triggering the extra payments.

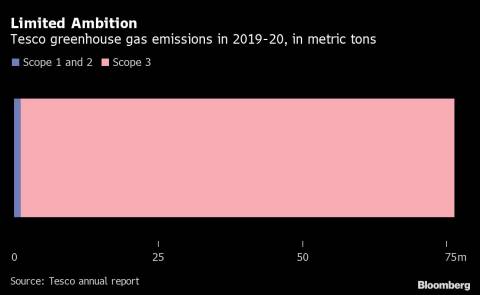

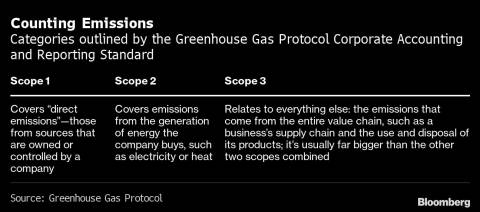

Consider the case of the UK’s largest grocery chain. Tesco Plc’s emissions stood at 76.4 million metric tons in 2020. As part of its climate plan, which a respected industry watchdog has approved, the company has committed to reducing direct emissions 60% by 2025 (from a 2015 baseline) and indirect emissions 17% by 2030.

Direct emissions, which include those produced by the company in its buildings or in power plants providing it electricity, are a mere 1.6% of its total footprint. The rest are the indirect emissions generated by the company’s suppliers or customers.

Tesco’s corporate goals cover both direct and indirect emissions. But the company’s SLB objectives are linked solely to direct emissions, leaving out 98.4% of its carbon footprint. What’s more, Tesco’s latest sustainability report shows that in 2021 the company was 90% of its way to meet its 2025 direct-emissions target. In other words, the company was already on the verge of meeting its unambitious goal as it was writing the bond documents it presented to investors. Tesco declined to comment.

After Bloomberg News reported on Tesco’s weak targets last year, one of the banks involved in selling the company’s SLBs held an internal meeting to educate colleagues about indirect emissions.

In an interview at the World Economic Forum in Davos, Switzerland, in May, Bloomberg News asked Michele Crisostomo, the chairman of Italian power company Enel SpA, whether he considered Tesco’s SLB to be an example of greenwashing. He said yes. But Enel, one of the world’s biggest users of SLBs, has also failed to tie any of its $20 billion of such bonds to the indirect emissions that accounted for more than 50% of its total emissions in 2021. A company spokesperson says future sustainability-linked bonds will include a Scope 3 target.

“We have seen investors start to ramp up pressure with regards to the importance of Scope 3,” says Arthur Krebbers, head of corporate climate and ESG capital markets at NatWest Markets Plc.

Many natural-gas transport companies—including A2A, Nederlandse Gasunie, and Snam—have issued SLBs. Their pipelines send gas across Europe and facilitate much of the continent’s energy use. Yet these companies have tied their direct Scope 1 and 2 emissions only to their bonds, leaving out a huge proportion of emissions.

A Nederlandse Gasunie NV spokesperson says Scope 3 targets are a “work in progress,” and a representative of Snam SpA says the company is open to including the targets in future bonds. A2A SpA didn’t respond to a request for comment.

“There are sectors where not having Scope 3 makes the product irrelevant,” says Orith Azoulay, global head of green and sustainable finance at Natixis CIB.

Carrefour SA, the French grocery giant, set sustainability objectives related to avoiding the use of packaging and reducing food waste. That’s good, but it doesn’t set any meaningful goals on emissions. A spokesperson for Carrefour says the scheduled date for its emissions targets was further out than the bond’s maturity date.

At other times, companies set targets linked to the bonds that have little to do with the company’s most significant impacts or actual carbon footprint. Aeroporti di Roma SpA issued an SLB with the intention of reducing the emissions produced by the transportation of its employees as they come to work at the airport. It left out the vast majority of the emissions that result from flights taking off and landing there. A spokesperson says ADR can influence only some of the sources of large emissions and thus chose to exclude emissions from planes in the “binding contractual commitment” needed for an SLB.

A bond from Teva Pharmaceutical Industries Ltd. included a direct emissions target, but it was easy to meet. The company could achieve it by reducing emissions at an even slower rate than they were already doing in the regular course of business.

It’s yet another “part of the greenwashing trend,” says Benjamin Sabahi, head of credit research at Spread Research. A Teva representative says the company’s targets are aligned with global climate objectives.

EQT AB Group, a private equity firm in Sweden, issued an SLB before even setting any climate targets. Instead, the company’s bond committed EQT to setting an emissions target that an independent third party would approve. EQT declined to comment.

The concerns about SLBs aren’t exclusive to the European market. Canadian oil and gas pipeline giant Enbridge Inc. issued a global bond last year that had a carbon intensity target rather than an absolute emissions target. Carbon intensity measures the emissions attached per unit of energy of the fossil fuels transported. It allows a company to appear greener than it might be, because it can lower its carbon intensity while increasing the amount of oil and gas it transports, therefore increasing its total emissions. Enbridge didn’t set any targets on the Scope 3 emissions generated from the burning of oil and gas. A company spokesperson says, “There is currently no guidance on what constitutes Scope 3 emissions” for pipeline companies.

So far, European regulators aren’t getting involved. A spokesperson for the European Securities and Markets Authority says it’s the role of each national regulator to ensure that investors get comprehensive, complete, and consistent information in a bond prospectus, but they don’t review the ambition level of sustainability-linked bonds.

Even if they’re not tied to challenging targets, the bonds can still play an important role in keeping companies on track to achieve their climate objectives, says Susan Barron, global head of sustainable capital markets at Barclays Plc. “This is not about incentivizing companies,” she says. “It’s about holding them accountable.”

But Trisha Taneja, global head of ESG origination and advisory at Deutsche Bank AG, concedes that bonds that require meeting easy goals aren’t making a real difference. “If the company reduced emissions by 2% every year for the past four years, then having a [target] that says we will continue to reduce emissions by 2%, that’s not ambitious,” she says. “That’s business as usual.”

In fact, Bloomberg News’s analysis found that more than half the targets set in all European SLBs issued until April 2022 fell in the business-as-usual category.

Pacific Investment Management Co., one of the world’s largest bond investors, is among the companies that buy sustainability-linked debt. Lupin Rahman, its ESG integration specialist, says buyers will become more demanding and effective as the market matures. “This is a very, very young market,” she says. “Two and a half years is nothing in terms of the history of investing, so this market is still finding itself.”

With drought, floods, and storms becoming more intense around the world, the question is how much longer the climate can wait. —With Flynn McRoberts, Jacqueline Poh, and Greg Ritchie

Azevedo Rocha writes about European credit markets; Rathi reports on green energy and environmental, social, and governance investing; and Gillespie covers European energy. All three are based in London.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Priscila Azevedo Rocha, Akshat Rathi and Todd Gillespie