(Bloomberg) -- Global bankers descended on Hong Kong for a major summit as the city seeks to relaunch itself as an international finance center after years of pandemic-induced isolation and a crackdown on dissent.

There’s been plenty of drama in the run up. Capital Group Cos.’s Chief Executive Officer Timothy Armour became the latest to drop out for health reasons, after Blackstone Inc. President Jonathan Gray and Citigroup Inc. Chief Executive Officer Jane Fraser, who both contracted Covid. The city’s financial secretary also tested positive on an overseas trip, creating doubt over whether he can join in person. An approaching tropical cyclone is raising the risk of disruptions.

The gathering still has big hitters. Goldman Sachs Group Inc.’s David Solomon and Morgan Stanley’s James Gorman will be among the 200 or so attendees at the Global Financial Leaders’ Investment Summit, which starts on Tuesday with a dinner. The main event is Wednesday, where executives will discuss everything from macroeconomic and geopolitical risks to the future of finance.

Read more: Solomon, Gorman Headline HK Summit Where 87% of Speakers Are Men

The summit comes against a backdrop of amid heightened tensions between the US and China, with the world’s two largest economies sparring in recent months over trade, human rights and Beijing’s aggressive moves against Taiwan. Chinese President Xi Jinping’s yearlong crackdown on private enterprise and the property market has sharply undermined investor confidence in the nation’s assets.

The stakes are high for global financial institutions, which retain a significant presence in the city. Many banks and asset managers have been on an investment and hiring spree in mainland China and Hong Kong in recent years as the world’s second-biggest economy opened its $60 trillion financial market. The combined disclosed exposure of the biggest Wall Street banks in China was about $57 billion at the end of 2021.

“Foreign banks are still keen to do business or explore opportunities in mainland China and Hong Kong,” said Lloyd Chan, senior economist at Oxford Economics. “However, banks will still have to grapple with a business environment that continues to be uncertain and challenging, as strained relations between US and China imply economic and financial risks, which they have to be watchful of.”

Such a high-profile gathering has drawn criticism. US Senator Jeff Merkley and Democratic Representative Jim McGovern urged US bankers to cancel their visit, Reuters reported.

Their attendance “only serves to legitimize the swift dismantling of Hong Kong’s autonomy, free press, and the rule of law by Hong Kong authorities acting along with the Chinese Communist Party,” McGovern wrote in a tweet last week.

Since Beijing imposed a broad national security law on Hong Kong in 2020, the city has jailed dozens of opposition figures and overhauled the legislature to give Beijing virtual veto power in the selection of the city’s leaders. Current leader John Lee, who was sanctioned by the US along with other officials for his role in the crackdown, will give the first keynote speech at the summit.

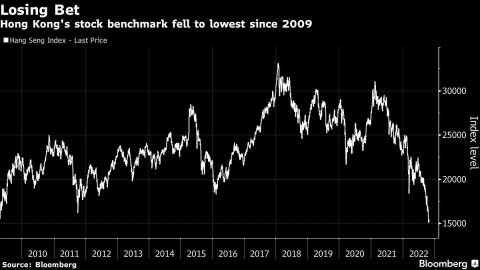

The summit, hosted by the Hong Kong Monetary Authority, comes as investors flee Hong Kong and mainland assets. The benchmark Hang Seng Index tumbled to its lowest level since 2009 last week as Chinese stocks tumbled amid concern over Xi’s increasing power. Shares of Hong Kong’s exchange operator have plunged more than 50% this year, reflecting a slump in daily turnover and initial public offerings. The local currency is near the weak end of its trading band against the dollar, showing capital outflows.

The number of attendees dropping out is increasing. Capital Group’s Armour will no longer attend Hong Kong’s financial summit because he’s “unwell”, a spokesperson said Tuesday. He was due to talk on a panel on Thursday. Barclays Plc Chief Executive Officer C.S. Venkatakrishnan also decided against the summit after scrapping his Asia trip.

The HMKA is updating the programme rundown to reflect the “replacement of a small number of speakers who need to change their travel plans mainly because of unexpected personal circumstances,” a spokesperson said in an emailed summit. “Hong Kong is well prepared for the potentially difficult weather and the summit is no different. The summit and its important conversations will proceed as planned.”

Severe tropical storm Nalgae is expected to be close to the Pearl River Estuary adjacent to Hong Kong on Wednesday, according to the city’s observatory.

Under the current plans, the executives will first attend a closed-door meeting with HKMA officials on Tuesday, followed by a welcome dinner at the M+ Museum overseeing the Victoria Harbour. The summit takes place the following day at the ballroom in the Four Seasons hotel, with moderators including Eddie Yue, chief executive of the HKMA.

The first panel, which will address the current turbulence in global economies and markets, features Gorman, Solomon, UBS Group AG Chairman Colm Kelleher and Bank of China Ltd. President Liu Jin.

On Thursday, top fund managers will take part in a forum at the main hall at the stock exchange, including Carlyle Group Inc. founder Bill Conway and Man Group Plc’s CEO Luke Ellis. The two panels are entitled “Creating Value Through Uncertainties” and “Managing Through Volatile Markets.”

The conference will be followed by the international Rugby Sevens tournament, which starts on Friday in its first return to the city since 2019.

The events are part of a series of measures aimed at reviving Hong Kong’s outlook. The city faces mounting competition from Singapore as a regional hub for global business and talent, while its economy has taken a hammering as the city delayed reopening.

Gross domestic product plunged 4.5% in the third quarter, according to advance estimates released by the government on Monday. That was far weaker than economists’ forecasts for a 0.8% decline and is the worst contraction since the second quarter of 2020.

While Covid curbs have been eased, attendees to the summit still face the following restrictions, according to the HKMA and the Health Bureau:

- Visiting guests will undergo Covid tests before departure, on arrival and throughout first three days

- Participants will stay at designated hotels, and events will only take place at specific venues, to help ensure they are segregated from residents and appropriate control measures can be deployed

- Attendees will be able to have meals with others in private rooms and visit certain venues that require active checking in the first three days, a tailored rule for the summit. Typically, visitors to the city are forbidden from dining out or going to bars in the first three days

- Guests who test positive can leave by chartered flight. Otherwise they will be subject to least seven days isolation, which can take place at home or in a hotel

--With assistance from Denise Wee.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Kiuyan Wong and Bei Hu