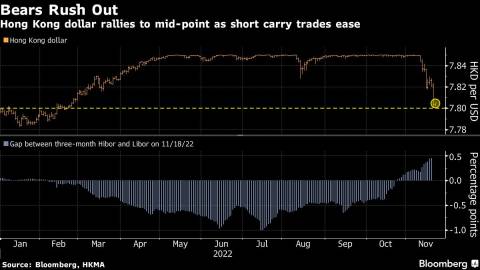

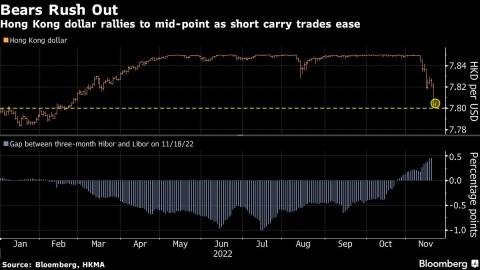

(Bloomberg) -- The resurgent Hong Kong dollar has pushed closer to the strong half of its trading band, amid a spike in local funding costs that has upended crowded bets on shorting the currency.

The Hong Kong dollar saw its biggest intraday rise in three years on Monday to as high as 7.8004 per dollar, bringing its gain for November to 0.6%. That puts it on track for the best month in two decades and is the closest the currency has been to the mid-point of its 7.75 to 7.85 trading band since February.

The rally came as the Hong Kong Monetary Authority’s intervention in the foreign-exchange market, which effectively lifted interbank funding costs, rendered a popular strategy of shorting the local dollar unprofitable. The city’s three-month funding costs rose to levels higher than the US equivalent for the first time since February last month.

“I expect the Hong Kong dollar to be settling at around a 7.80 handle before the next Federal Reserve meeting in December,” said Ken Cheung, chief Asian FX strategist at Mizuho Bank Ltd. in Hong Kong. “Meanwhile, the Hong Kong dollar liquidity withdrawal due to FX intervention will pause for a while.”

Hong Kong Dollar Rides Pivot Wave to February High

The Hong Kong dollar had been trading near the weak end of its band for almost half of this year, as investors borrowed the currency cheaply and sold it against the higher-yielding greenback. Now, the tables have turned, with local authorities’ intervention shrinking the interbank liquidity pool by about 70% in the past six months.

“Shorter-end Hong Kong dollar rates started to pick up more rapidly against US counterparts,” said Stephen Chiu, chief Asia FX & rates strategist at Bloomberg Intelligence. The move “favors Hong Kong dollar over the US dollar now from a carry perspective,”

Inflows into Hong Kong stocks have also been supporting the local currency. Mainland Chinese traders have piled into Hong Kong stocks recently via the stock connect schemes, with southbound trading poised for a third month of net buying, according to data compiled by Bloomberg.

--With assistance from John Cheng.

(Adds analyst comments, background)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Tian Chen and Chester Yung