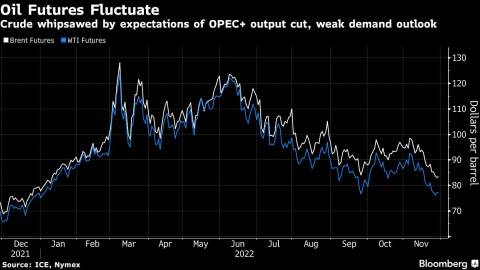

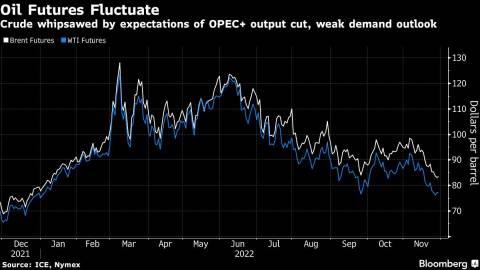

(Bloomberg) -- Oil steadied as Federal Reserve policymakers signaled further increases in interest rates, and traders tracked developments in China after Beijing moved to suppress anti-Covid Zero protests.

West Texas Intermediate held above $77 a barrel after closing up 1.3% on Monday following a report that the Organization of Petroleum Exporting Countries and its allies may consider deeper supply curbs when they meet this weekend. US central bank luminaries including New York Fed President John Williams stressed they will raise borrowing costs further to curb inflation.

Crude fell as much as 3.5% earlier on Monday after rising Covid-19 cases and demonstrations against virus curbs across China over the weekend buoyed the dollar and dented investor appetite for commodities including oil. However, the situation on the streets has quietened amid a heavy police presence.

Oil has retreated by more than 10% this month as tighter monetary policy sets the stage for a global slowdown that could endanger energy consumption. Those concerns, as well as doubts about demand in China, prompted OPEC+ to announce a major output cut last month, and delegates from the group now say that additional reductions could be an option. Ahead of the meeting, widely watched market metrics point to abundant near-term crude supplies.

“There is near-term risk to the demand outlook,” said Charu Chanana, market strategist at Saxo Capital Markets Pte in Singapore. “OPEC+ is likely to remain more concerned about the technical picture in the oil market turning negative, and that is likely to force the cartel to respond.”

In Europe, meanwhile, talks between European Union diplomats to agree on a price cap on Russian oil have stalled. Member states debated whether to set a limit as low as $62 a barrel but failed to reach an agreement. The measure is meant to deprive Russia of revenue following its invasion of Ukraine. Moscow has said it won’t sell crude to nations abiding by the cap.

Key market metrics have weakened substantially this month, with the prompt spreads -- the difference between the two nearest contracts -- for both Brent and WTI moving into bearish contango patterns. The gap for Brent was 72 cents a barrel in contango, compared with $1.32 in backwardation two weeks ago.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Yongchang Chin