(Bloomberg) -- Hybe Co., manager of the South Korean sensation BTS, is jumping into the middle of a messy corporate battle, allying with the godfather of K-pop to hinder technology giant Kakao Corp.’s foray into the entertainment arena.

Hybe launched a hostile bid for shares of SM Entertainment Co., coming to the aid of founder Lee Soo-man as he fights to block SM’s current management’s deal with Kakao, operator of Korea’s most popular messaging and social media service. That 217 billion won proposal — backed by activist shareholder Align Partners Capital Management — would have made Kakao the second-biggest shareholder in SM and diluted Lee’s control over the company.

Hybe, the No. 1 K-pop agency with New Jeans and other popular groups, said it will buy a 14.8% stake from Lee and offered to purchase another 25% in the agency from investors, according to filings on Friday. Hybe is offering 120,000 won per share, a 22% premium to closing price of SM on Thursday, for a total of 1.14 trillion won ($900 million).

SM executives issued a statement opposing the offer. Activist Align said the price is too low, given the agency’s expected growth in sales and profit, adding that Hybe should buy all shares in a tender off, to prevent a conflict of interest between shareholders of the two rival talent agencies.

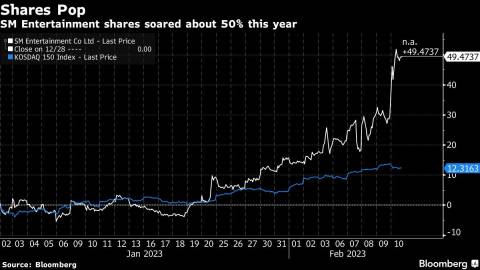

SM’s shares soared as much as 19% in Seoul trading, hitting an all-time high. Hybe rose more than 10%, while Kakao fell as much as 6.5%.

At stake are the futures of SM, the agency behind Girls’ Generation and Super Junior, as well as Kakao’s ambitions in the entertainment business.

SM’s deal with Kakao is widely seen as a step toward the internet giant’s eventual takeover of the agency. Kakao’s entertainment unit is weakest in K-pop, while Kakao’s platform would give SM artists a bigger audience and make them trendier, said Kim Hyunyong, an analyst at Hyundai Motor Securities.

The two sides had been exploring a partnership for a long time, but no decision has been made of a further acquisition of SM shares, according to Kakao’s holding company. Kakao had previously said its entertainment unit Kakao Entertainment Corp. could step in to purchase SM’s shares. Kakao Entertainment — which recently attracted $930 million from the sovereign wealth funds of Saudi Arabia and Singapore — may consider buying SM shares to strengthen their partnership, but nothing has been decided, Kakao Entertainment said in a statement to Bloomberg.

For Hybe, such an alliance would pose a threat, by expanding Kakao’s entertainment business to rival its own. Its interests matched those of Lee, the founder of SM, said Lee Hwajung, an analyst at NH Investment & Securities.

“Lee Soo-man was in urgent need of an ally to win the race against the SM board-Kakao-Align alliance,” she said.

SM’s founder Lee, who is also the K-pop pioneer’s largest shareholder, said he would take legal action to block the board’s decision to sell new shares and convertible bonds to Kakao. On Wednesday, he formally filed an injunction with a Seoul court.

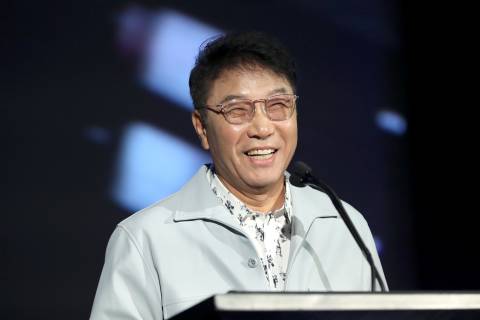

The 70-year-old Lee, credited with blazing a trail for K-pop’s global forays dating back to the early 2000s, remains a looming figure in the world of K-pop.

But his business ties with the agency he founded have been subject to criticism from shareholders and activist funds, who have pushed for better corporate governance and shareholder returns. A contract with SM helped Lee’s wholly-owned boutique firm Like Production make 160 billion won over the past 10 years, analysts estimate. SM terminated that contract in December, later removing Lee from his role as chief producer. It has also agreed to appoint activist Align’s chief to its board.

Hybe’s founder Bang Si-hyuk publicly voiced support for SM founder Lee on Friday.

“Hybe fully agrees with former Chief Producer Lee’s strategic initiatives including metaverse, a multi-label system, and the sustainable vision campaign,” Bang said in a statement.

As the largest shareholder, Hybe said it will push for corporate governance reforms as well as shareholder value improvement. The management company of BTS has been transforming itself into a platform company through a fan community app called Weverse and seeks to expand its virtual territory through a partnership with SM, it said.

SM’s top executives, including its co-CEOs, said they oppose any attempts for a hostile takeover from outsiders, including Hybe, according to a joint statement. The executives urged shareholders and stakeholders to support their vision for the company and move forward from a past where authority was centered in one person.

Hybe said this week it will buy Quality Control, the Atlanta-based label behind rap stars Lil Baby and Migos, as the agency seeks to bolster its presence in the US music market. Hybe made a $1 billion acquisition of Ithaca Holdings LLC, the media group behind the careers of Justin Bieber and Ariana Grande, in 2021.

(Updates with share reaction and analyst comments from fifth paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Author: Sohee Kim, Shinhye Kang and Youkyung Lee