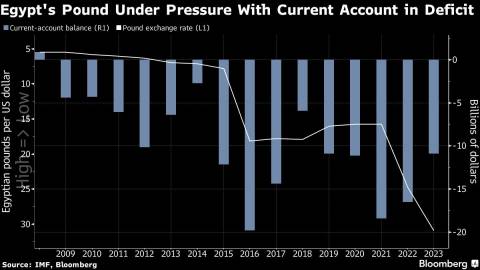

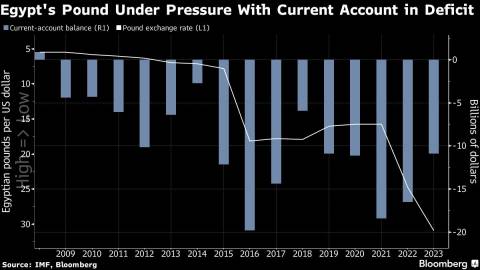

(Bloomberg) -- S&P Global Ratings took a far more downbeat view of Egypt’s finances than the International Monetary Fund and forecast a further currency depreciation in lowering the country’s outlook to negative.

Though expecting enough net flows to cover Egypt’s current-account deficits through fiscal year 2026, S&P projects the central bank’s gross reserves will average about $32 billion during the period — only half the level the IMF sees them reaching over the same time. The stockpile has risen above $34 billion in recent months.

S&P also anticipates the local currency will decline by about 53% by the end of this fiscal year to June 30, from 12 months earlier, “followed by a modest depreciation in the subsequent years,” analysts led by Trevor Cullinan said in a statement last week.

The rating company affirmed Egypt at B, seven notches above default and on par with Nicaragua, Montenegro and Uganda.

In S&P’s view, “Egypt’s funding sources may not cover its high external financing requirements” this fiscal year and next, which it estimates at a cumulative of about $37 billion.

It warned that “lack of progress” in implementing reforms announced last December increases risks that backers including wealthy Gulf allies “potentially delay or do not provide Egypt with the agreed funds, with implications for imports, inflation, interest rates, and the government’s debt stock and interest payments.”

Around 70% of Egypt’s government debt is domestic and in local currency, according to S&P. It estimates the government channels over two-fifths of all revenue for interest payments, the third-highest such ratio among the 137 sovereigns it rates globally.

S&P is the third major credit assessor to take negative action on Egypt in recent months, as the economic fallout of Russia’s invasion of Ukraine contributed to the country’s worst foreign-currency crunch and highest inflation in years.

In February, Moody’s Investors Service downgraded Egypt’s debt score deeper into junk territory, following a decision by Fitch Ratings last November to lower its outlook to negative from stable. While Fitch rates Egypt one step above S&P, Moody’s already has it a notch lower at B3.

The government has committed to allowing a more flexible exchange rate, enabling it to clinch a $3 billion deal with the IMF. Still, declines in the currency continued to be followed by long stretches of stability.

S&P said the IMF has “a more optimistic view” on Egypt’s gross reserves “as the balance of payments improves and program financing is disbursed.”

For now, however, the IMF wants Egypt to enact more of the wide-ranging measures it pledged before carrying out the first review of its assistance program, waiting to see privatization deals for state assets and genuine flexibility in the currency.

Though the pound has traded little changed in the spot market, concern among investors has built over what would be Egypt’s fourth devaluation since March 2022. The currency has weakened about 50% over the past year, but remains far stronger than rates quoted in the black market, underscoring the risk of further depreciation.

S&P said a major reason the currency has recently been under pressure is that businesses are “hoarding foreign-currency earnings, given the uncertainty regarding the Egyptian pound’s value.”

As industries that earn hard currency cling to their dollars, the interbank market is experiencing “relatively limited availability” of foreign exchange because domestic and international banks “have been uncomfortable with the level of policy uncertainty,” S&P said.

“There is currently limited day-to-day movement in the official exchange rate,” S&P said. “We understand that this is due to limited demand as market participants appear reluctant to purchase foreign currency, while rumors of further devaluations circulate.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Author: Paul Abelsky