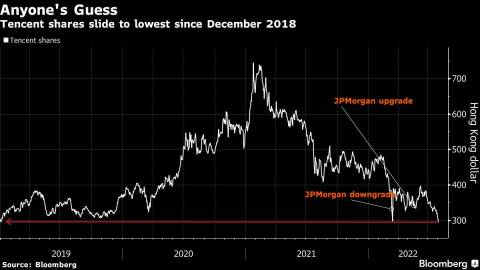

(Bloomberg) -- Predicting the returns of Chinese technology stocks is harder than ever in an age of shifting government policy, rising interest rates and cooling economies.

Take JPMorgan Chase & Co.’s Alex Yao. He downgraded 28 Chinese internet stocks in March, calling the industry “uninvestable” --- right before an epic rally. He then shifted to upgrade the sector in mid-May and, while indexes are higher since then, the biggest company, Tencent Holdings Ltd., is down nearly 20%. Alibaba Group Holding Ltd. is a hair’s breadth away from wiping out all the gains since Yao upgraded the stock.

An investor following Yao’s recommendations on Tencent would have lost 48% over the past year, worst among the analysts following the stock, according to Bloomberg-compiled data. Still, Yao has plenty of company. Strategies from many analysts on the stock would have generated losses of more than 30%. Yao and JPMorgan didn’t respond to requests for comment.

“Our feeling is that it will be very difficult to time the right moment to move into China,” said Tom Masi, a New York-based portfolio manager at GW&K Investment Management. “What we are experiencing now is the repercussions of the slowdown from Covid lockdown, a greater uncertainty about the property market, rising pressure from unemployment.”

Chinese internet stocks have seen wild swings even by the standards of the volatile tech sector.

The Nasdaq Golden Dragon China Index of US-listed companies lost three quarters of its value from a February 2021 peak through a low in March this year, crushed by a government regulatory crackdown. Then, China’s sweeping promise that the worst of the scrunity was over spurred an almost 60% jump in the benchmark. But that rally petered out in late June on mounting concern that companies will be delisted from US exchanges and that earnings will be curbed by the economic slowdown.

Tencent on Tuesday dropped to the lowest since 2018 after it failed to obtain new online game licenses.

Yao’s blockbuster March call shouldn’t have used the word “uninvestable,” people familiar with the matter said in May. JPMorgan staff in charge of vetting the bank’s research asked for it to be removed from the 28 reports penned by Yao and his team before they were published, the people said, but it slipped through in four of them because of an editorial error.

For now, the majority of analysts are still sticking to their bullishness. Tencent has the most buy recommendations of any Asian company, while Alibaba and delivery giant Meituan are also near the top of the list, according to data compiled by Bloomberg. Analysts are expecting the three stocks to rise at least 38% in the next 12 months.

The August earnings season will provide a reality check. Analysts predict a weak quarter for China technology firms, as the April-June period was interrupted by the nation’s lockdowns of major cities. Alibaba is expected to report its first-ever quarterly drop in revenue this week.

“Confidence will need to grow in the state’s willingness to let these companies thrive,” said David Waddell, CEO and chief investment strategist at Waddell & Associates. “Confidence will need to grow that the Chinese lockdowns will relent. Confidence will need to grow that recessions in the developed world won’t sink the developing world.”

Tech Chart of the Day

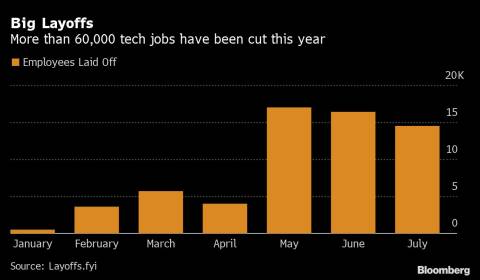

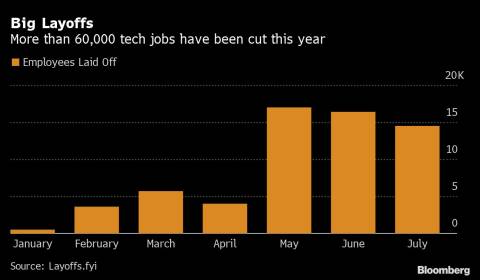

Technology companies have cut more than 60,000 jobs this year, according to Layoffs.fyi, which tracks both publicly traded and closely held businesses. On Monday, Oracle Corp. laid off employees in marketing and its US customer experience division, though the extent of the cuts couldn’t immediately be determined. Barclays Plc analyst Raimo Lenschow said “management is taking a proactive approach” as economic headwinds hit the software giant. The stock has fallen 11% this year, compared to the Nasdaq 100’s 21% dip.

Top Tech Stories

- Uber Technologies Inc. reported revenue that beat analysts’ estimates, boosted by resilient demand from customers who continued to hail rides and order takeout food despite rising inflation. Shares jumped about 11% in early trading.

- Oracle cut jobs in marketing and the US customer experience division, signaling a pullback in customer analytics and advertising services.

- Pinterest Inc. jumped after reporting resilient sales and user numbers and Elliott Investment Management confirmed a major stake, saying it approved of the company’s leadership. Shares gained about 20% in extended trading.

- Activision Blizzard Inc., the biggest US video game publisher, reported revenue that beat analysts’ estimates, but adjusted sales declined 15% from a year ago due to a soft Call of Duty launch last fall and a slow year for the gaming industry overall.

- As the US Congress passed an historic $52 billion federal program to boost domestic chipmaking capabilities, it included one significant caveat: Companies that receive the funding have to promise not to increase their production of advanced chips in China.

- Hedge fund billionaire Steve Cohen exited his investment in cryptocurrency trading startup Radkl, according to a spokesperson for the digital-asset company.

- The weaker yen has triggered price hikes on electronics from iPhones to refrigerators across Japan this year, with one glaring exception: the video game console.

- Amazon.com Inc. hired a senior Republican congressional aide, bolstering its efforts to stymie a new antitrust bill aimed at US technology companies, according to two people familiar with the hire.

- The US’s top auditor watchdog is throwing cold water on a workaround that’s been floated as a way to avoid the delisting of nearly 200 Chinese companies from American stock exchanges.

- Apple Inc. tapped the US high-grade bond market Monday with a $5.5 billion sale in four parts.

- Skyports Ltd., which builds takeoff and landing sites for flying taxis, drew investment from Singapore Technologies Engineering Ltd. amid plans for a terminal in the city for airborne electric cabs.

(Updates to add in eighth paragraph that JPMorgan had intended to remove “uninvestable” from March reports)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Jeanny Yu and Yiqin Shen