(Bloomberg) -- After getting thrashed in the era of low interest rates, the last remaining hedge fund managers dedicated to the world of foreign exchange are in fighting spirits this year.

Aggressive Federal Reserve tightening is sending the US dollar to historic highs and spurring big moves across exchange rates from Europe to Asia. That’s proving a godsend for a small band of FX-focused quant traders and discretionary managers as they notch some of their biggest wins since the halcyon days of the pre-2008 era.

Hedge funds in the industry tracked by Eurekahedge Pte Ltd. are poised for their best year since 2003 as volatility rises and monetary policy diverges. Thanks to the extended rally in the greenback and the resulting plunge in the euro and yen, trend-chasing currency managers in a BarclayHedge index are also set for their strongest performance since 2003.

The likes of currency specialist P/E Investments, meanwhile, are enjoying double-digit gains by riding reliable statistical patterns across markets.

“If you had told someone a year ago the yen would be pushing 140, or the euro would be at parity, they wouldn’t have believed you,” said Andrew Beer, founder of New York-based Dynamic Beta Investments, which has $1.1 billion of assets under management and seeks to replicate hedge-fund returns. “These are absolutely staggering moves.”

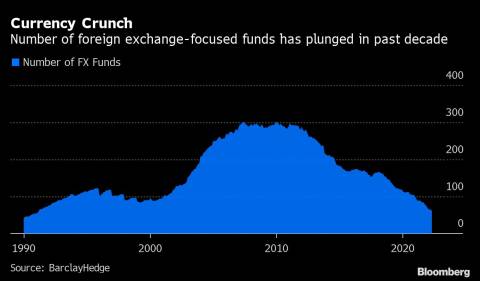

All this is a world away from the hostile market regime after the global financial crisis, when central bankers launched dovish policies in unison -- upending carry and momentum strategies while snuffing out price swings and macro trends. That sparked a crisis for such traders which endures today even with the recent windfall. The number of FX-focused private funds was at its peak in January 2010, according to data provider BarclayHedge, but the count has since fallen by nearly 80%.

“Very few new funds are being created, while record numbers appear to be disappearing,” said Benjamin Crawford, vice president and head of research for BarclayHedge. “The largest of the large appear to be reaping the benefits.”

With US inflation still rampant, the Fed is embarking on one of its fastest rate-hiking campaigns in history, just as economic fears rise. That’s stoked broad dollar strength and caused currency weakness in much of the world -- providing an aid to traders who invest on the basis of macro trends and those chasing the momentum of prices.

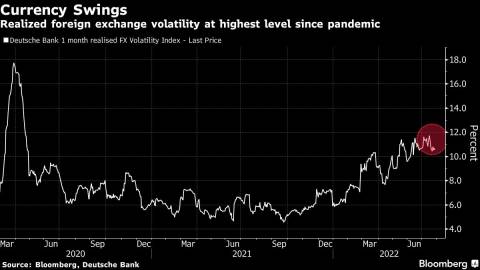

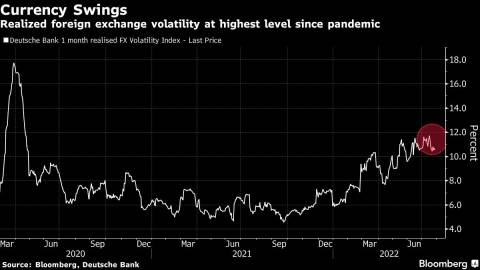

At the same time, the war in Ukraine has added to risk aversion, with a Deutsche Bank AG gauge of currency volatility rising recently to levels last notched in the early days of the pandemic. That’s helping traders arbitrage bets among different markets.

“It’s a complete 180,” said Pablo Calderini, chief investment officer at Graham Capital Management LP, a global macro investment firm. “Central bankers have to hike, and they have to hike by a lot. Fixed income is at the epicenter of the storm, but so are commodities, equities and, of course, FX.”

The Norwalk, Connecticut-based investor helps oversee a $1.5 billion macro strategy that’s up 45% in the first half of this year, fueled by long dollar positions and wagers against the euro and yen, which have both crashed to two-decade lows in the era of Fed hawkishness. Graham Capital has $18 billion of total assets under management.

Boston-based P/E Investments, meanwhile, has notched a 16% return this year through June in its FX Standard Strategy, and has $13.7 billion allocated to currency strategies, according to a person familiar with the matter. It allocates on the basis of statistical patterns factoring in volatility and market risk.

A P/E Investments spokesperson declined to comment.

Traders may see even more opportunities ahead given elevated uncertainty over the outlook for inflation and economic growth. For example, Alan Ruskin, chief international strategist at Deutsche Bank, predicted the euro could shoot up as much as 30% if there’s a solution to Europe’s energy crisis -- something that could provide outsize gains for currency funds on the right side of the trade.

Others, such as macro hedge fund EDL Capital AG, are betting that the euro could plummet 20% more, to as low as 80 US cents.

Higher interest rates should also help fund managers generate fresh returns from carry strategies, according to Luc de la Durantaye, chief investment officer at CIBC Asset Management. The strategy involves borrowing in a low-yielding currency to invest in a higher-returning counterpart.

“There’s a less globally synchronized economic cycle now,” he said. “That’s going to create more volatility but also push correlation lower, which is going to generate even more opportunities.”

Still, easy money-spinning bets like the dollar rally are unlikely to be repeated any time soon, while hopes for a spirited industry rebound have been dashed time and time again. That suggests dedicated currency funds will remain a rare breed for now.

It’s unlikely new currency funds will emerge from the most recent bout of volatility, said Melissa Brown, a former partner at Goldman Sachs Group Inc. and now head of applied research for advisory firm Qontigo. “But we’re going to for sure see more focus on currencies from an investing standpoint.”

Investors may instead lean on other strategies.

“Even with the success of FX now,” said Calderini of Graham Capital, “people are realizing it’s more optimal to allocate to funds that aren’t restricted to trading one asset -- that can trade multiple assets, all within the context of global macro.”

(Updates with researcher’s comments in antepenultimate paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Amelia Pollard